Manufacturers Insurance Made for Your Business

The manufacturing industry faces unique risks. That’s why manufacturers insurance is important to have, helping protect your company when you need it most. We make it easy to customize your policy so you can get exactly what you’re looking for.

Manufacturers Insurance for Small Business Owners

Every small business owner tries to run their company perfectly, but mistakes can happen. If they do, having the right type of business insurance is important. It can help your company respond to claims or lawsuits. Claims can come up during everyday business operations, that’s why it’s important to have manufacturers insurance that helps protect your business.

Who Needs a Manufacturer Insurance Policy?

- Air conditioning equipment manufacturers

- Appliances and accessories manufacturers

- Bakery products manufacturers

- Children’s clothing manufacturers

- Craft breweries

- Eyeglass lens manufacturers

- Fruit drinks, soda, spring or carbonated water manufacturers

- Metal goods manufacturers

- Plastic goods manufacturers

- Sign manufacturers

What Are the Best Insurance Policies for Manufacturing Companies?

Many manufacturing companies start with a Business Owner’s Policy (BOP). This combines three types of coverage that are essential to many small business owners:

If your manufacturing small business also has employees, most states require workers’ compensation insurance.

Covering Your Manufacturer Operations

Property damage, claims and lawsuits have the potential to significantly impact your manufacturer operations. Whether you need to fix or replace machinery after a covered loss or your business has to temporarily shut down after property damage, manufacturers insurance can help you reopen as quickly as possible.

Nearly half of unplanned downtime with electrical equipment and machinery is due to hardware failure and malfunction.1

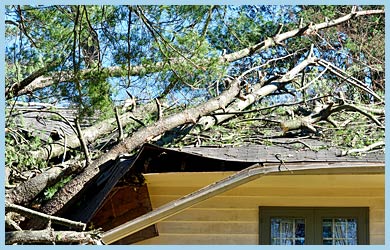

Power Loss

“We had to shut down our manufacturing facility for a few days after a huge tree limb fell across one of the power lines and caused us to lose power.”

Business Income for Off Premises Utility Services coverage helps your business if you can’t operate because of an interruption in power, communications or water services.

Product Recall

“We had to issue a recall when we realized one of our products caused injuries when customers used it.”

Product recall coverage can help pay your costs to recover the product from distributors, purchasers or users.

Protecting Your Manufacturing Property

We know how hard you work to run a successful manufacturing business. Your company property is essential to your business. Manufacturers insurance gives you peace of mind knowing your property has protection.

There are over 37,900 fires at industrial or manufacturing properties reported each year.2

Car Accident

“One of my employees was driving our delivery van to drop off some products to a customer. On the way there, he rear-ended another car.”

Commercial auto insurance helps protect you and your employees on the road while driving a business-owned vehicle for work. It can help cover property damage and bodily injury costs.

Fire Damage

“A fire broke out in our manufacturing warehouse and caused pretty bad damage to some of our machines. So much so that we had to replace most of them.”

Commercial property insurance helps protect the owned or rented equipment and tools you use to operate.

Protecting Your Manufacturing Team

Your workers have a key part in the success of your manufacturing small business. If they get a work-related injury or illness or can’t do their job, it can have an impact on your business. Manufacturers insurance can help you take care of your team.

The manufacturing industry accounted for 15% of all nonfatal injuries and illnesses in 2019.3

Employee Injuries

“My foreman got hurt while driving a forklift in our manufacturing facility. He had to miss work for two weeks until he fully recovered.”

Workers’ compensation insurance gives your employees benefits if they get a work-related injury or illness. It can help cover their treatment costs and replace most of their lost wages if they can’t work.

Employee Harassment

“We had to fire a worker after we found out they were harassing another employee. We have a zero-tolerance policy for that behavior, but the employee sued us for wrongful termination.”

Employment practices liability (EPLI) insurance can help protect your business from certain claims, like wrongful termination.